Do you use the appropriate retirement income strategies to reduce sequence of return risk?

In football, the space within 20 yards of the opposing team’s end zone is known as the Red Zone. The goal is so close the offense can taste it. But the defense knows they’re in trouble, so they step up their game. Scoring in the Red Zone can be very difficult.

The same can be said of saving and planning for retirement. The closer the end zone (retirement), the more difficult it can be to make progress toward the goal, and any fumbles in the market could mean big trouble.

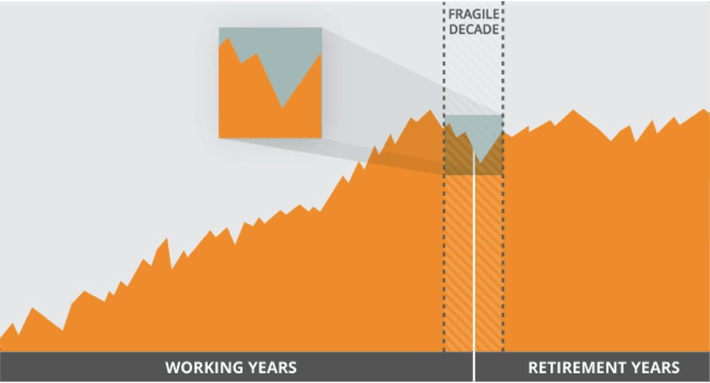

How many individual investors understand the dangers of the Red Zone, a.k.a. the “Fragile Decade,” that 10- year period surrounding retirement in which the sequence of events and decisions made will have the greatest effect on retirement outcomes?

Even if they’re aware of the Fragile Decade, do they understand that the right strategy for success in the Red Zone may look different than what they’ve done the last 25 years? If you fall into this category, there’s a good chance you’ll need to craft a more custom retirement income approach around these critical years.

Investors approaching their targeted retirement date in five years or less need to identify not only items such as how much income they’ll need, when to enroll in Medicare, and how to optimize social security, but they should also adjust their asset allocation in order to minimize sequence of return risk.

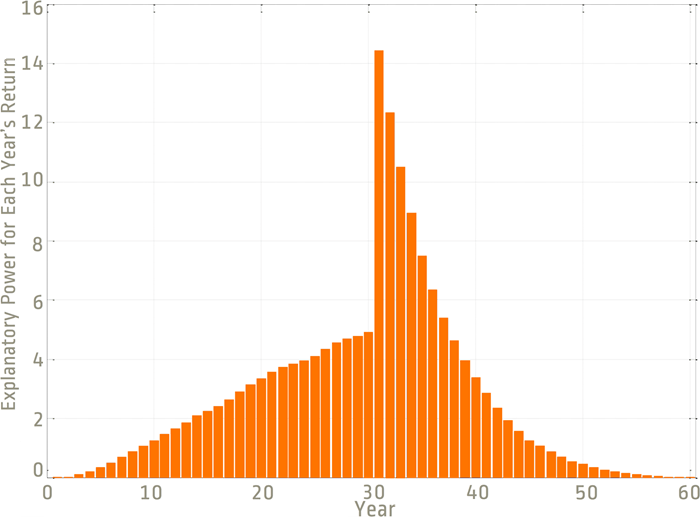

There has been extensive research on sequence of return risk and which retirement income strategy makes the most sense for pre-retirees and retirees (probability-based or safety-first?). The work in this area is invaluable as investors approaching retirement should assess their ability to retire using numerous factors and modify risk exposure as their human capital moves closer to zero.

While advisers employ various types of retirement income solutions for clients, a solution we often find useful is a rising equity glide path. While it’s not for everyone, it can be used to:

- Reduce portfolio volatility

- Employ academic evidence for a valuation-based approach

- Help investors who can’t afford to take significant equity market risk

- Assist investors who desire a probability-based approach, but fear and behavioral reasons loom The challenge is this may seem counterintuitive to many. We want to help our clients understand today’s environment, their own individual risks, and show them how our advice will improve retirement outcomes.

When determining an appropriate asset allocation or glide path approach, it’s important to be mindful of key considerations and individual objectives:

1) Would a steep equity market drop in the near-term have a significant impact on you as you are approaching retirement?

Most of you would probably say yes; however, your adviser may be the only one who knows the real answer. It’s their job to educate and understand whether this would be the case and how to structure your individual retirement income solution accordingly.

2) Will you have the ability or desire to maintain a flexible spending approach in retirement to account for market fluctuations and other conditions?

Often this depends on your view of essential vs. discretionary needs. Some individuals may view all of their needs as “essential” given how hard they have worked to be able to retire. Your adviser can also help you understand why maintaining a flexible spending approach can help improve your outcome given the current interest rate environment and market conditions.

3) Is your adviser able to effectively communicate this type of approach with you?

This kind of discussion needs to be approached deliberately and cautiously. Whether someone is using a total return, bucketing, or rising glide path strategy, individual investors may not understand the difference. That’s where your adviser comes in. They can help you understand how these types of approaches may improve your outcome in retirement.

With the large number of individual investors currently living in the Red Zone, it’s important they are not exposed to excessive or unnecessary portfolio risk. Advisers are your offensive line, watching out for obstacles and danger. This is a significant opportunity to create customized solutions for you at a time when you need it most.

Contact Information

1942 W CR 419 #1030

Oviedo, FL 32766

407 542-7232

steve@firstdownfinancialinc.com

Business Hours

- Mon - Fri

- -

- Saturday

- Appointment Only

- Sunday

- Closed

Financial Planning - Portfolio Managment - Tax Planning - Annuities - Life Insurance

We are an independent financial services firm helping individuals create retirement strategies using a variety of investment and insurance products. Advisory services are provided through First Down Financial, Inc. a registered investment advisor.

All reports, publications, podcasts, audio files, and the content contained therein provided via this website are for informational purposes only. Content of podcasts is current as of the time of recording. No content available on this site is intended to provide tax or legal advice or personalized investment advice, nor is it an offer or solicitation to buy or sell securities. Views and opinions may change based on new information or analysis. First Down makes no assurance as to the accuracy of any forecast made. Figures, references, and data cited in all written and audio content are obtained from sources believed to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information.

Investing involves the risk of loss, and some strategies may not be right for you. Past performance does not guarantee future return. Hypothetical outcomes do not reflect actual investment results and are not guarantees of future results. All assumed, expected, or stated returns are not guaranteed unless otherwise stated. Indexes are not available for direct investment. A professional advisor should be consulted before undertaking any strategy or implementing any specific advice. Always consult an attorney or tax professional regarding your specific legal or tax situation. By requesting any report available via this site you may be provided with information regarding the purchase of insurance products or investment advisory services in the future.

First Down Financial Services is not affiliated with any government agency, including the Social Security Administration. For information regarding your specific situation, it is recommended to contact the Social Security Administration.

*"Peace of Mind," "Safety," "Principal Protection," "Lifetime Income, "Guaranteed Income," or other guarantees are associated with fixed insurance products. No such language refers in any way to investment advice, investment advisory products, securities, or recommendations provided by First Down Financial Services. Investing involves risk. Rates of return are not guaranteed unless otherwise stated. All guarantees relating to insurance products are dependent on the financial strength and claims-paying ability of the issuing insurance company. Guarantees may be subject to various restrictions, limitations, or fees, which can vary depending on the issuing insurance company. Annuities have limitations and are not appropriate for all circumstances or individuals. They are not intended to replace emergency funds or to fund short-term savings or income goals. Investing involves risk.

Lifetime income may be available on certain products through an optional rider at no cost or for an additional cost, depending on the specific product and contract. Taking withdrawals prior to turning age 59 ½ may result in tax penalty fees in addition to ordinary income taxes. Withdrawals from annuities may trigger charges or reduce the contract value and death benefit. Insurance products are not insured by any federal government agency and may lose value.

First Down does not solicit or request reviews appearing on this page from non-clients, and clients are under no obligation to provide reviews. On occasion, First Down Financial provides non-cash prizes such as gifts or gift baskets to existing clients in exchange for testimonials and referrals. All such non-cash compensation adheres to all applicable regulations.